Money Mastery: Must-Reads for Young Adults!

Introduction

This article introduces a selection of top finance and money books, each carefully chosen to guide young adults through the complexities of personal finance. These books are not just about managing money; they're about building a foundation for a financially secure future.

For young adults stepping into the realm of financial responsibility, the right information can make all the difference. Each book on our list addresses a different aspect of financial literacy, from managing debt and understanding student loans to mastering the art of wealth accumulation.

These books are more than educational resources; they are tools for empowerment, designed to help young adults make informed financial decisions.

Comprehensive List of Must-Read Finance Books for Young Adults

-

"How to Money" by Jean Chatzky

Overview: "How to Money" by Jean Chatzky is a perfect starting point for young adults who are new to managing their finances. This book breaks down complex financial concepts into understandable and relatable language.

Key Takeaways: It covers essential topics such as budgeting, saving, investing, and making smart financial choices. The book is particularly noted for its practical approach, offering actionable steps to take control of your financial future.

-

"I Want More Pizza" by Steve Burkholder

Overview: "I Want More Pizza" by Steve Burkholder presents financial concepts in a fun and engaging way. It's tailored to resonate with young adults, using real-life scenarios and easy-to-understand analogies.

Key Takeaways: The book covers how to manage money effectively, save for the future, and make money work for you. It’s an excellent resource for those who want to learn about personal finance in a light, yet informative manner.

-

"Broke Millennial" by Erin Lowry

Overview: "Broke Millennial" by Erin Lowry targets young adults facing the challenges of the modern financial world. It offers a fresh perspective on managing finances in a way that is both informative and entertaining.

Key Takeaways: This book addresses a range of topics from handling student loans to negotiating your first salary. It empowers readers with the knowledge to make informed financial decisions and to approach money matters with confidence.

-

"Get a Financial Life" by Beth Kobliner

Overview: "Get a Financial Life" by Beth Kobliner is a comprehensive guide for young adults facing the financial realities of the modern world. It provides a roadmap for managing finances in your twenties and thirties.

Key Takeaways: The book covers a wide range of topics, including dealing with debt, navigating the complexities of insurance, and understanding the basics of investing. It's praised for its clear, accessible advice that's particularly relevant to young professionals.

-

"Rich Dad, Poor Dad for Teens" by Robert T. Kiyosaki

Overview: "Rich Dad, Poor Dad for Teens" by Robert T. Kiyosaki adapts the classic personal finance lessons of the original book for a younger audience. It teaches teens about the importance of financial education.

Key Takeaways: This book focuses on the value of money, investing, and how to start building wealth at a young age. It encourages teens to think differently about money and to learn the importance of making smart financial decisions early in life.

-

"Pay Less for College" by Brad Baldridge

Overview: "Pay Less for College" by Brad Baldridge is a practical guide for students and parents navigating the often overwhelming world of college financing.

Key Takeaways: The book offers strategies for reducing college costs, understanding financial aid, and making informed decisions about student loans. It's an essential read for families looking to minimize the financial burden of higher education.

-

"The Infographic Guide to Personal Finance" by Michele Cagan and Elisabeth Lariviere

Overview: "The Infographic Guide to Personal Finance" by Michele Cagan and Elisabeth Lariviere presents financial concepts through visually engaging infographics. It's an innovative approach to understanding personal finance.

Key Takeaways: This book simplifies complex financial topics like budgeting, investing, and debt management. It's ideal for visual learners who appreciate clear, concise, and engaging presentations of information.

-

"Why Didn’t They Teach Me This in School?" by Cary Siegel

Overview: Cary Siegel's "Why Didn’t They Teach Me This in School?" addresses the gap in practical financial education. It's written for young adults who are just starting to manage their own money.

Key Takeaways: The book offers 99 principles and tips for personal money management. It's a straightforward guide that covers everything from saving and spending wisely to the basics of investing.

-

"How to Adult: Personal Finance for the Real World" by Jake Cousineau

Overview: In "How to Adult: Personal Finance for the Real World," Jake Cousineau offers a down-to-earth guide to managing finances for those entering adulthood.

Key Takeaways: This book covers a range of essential topics, including creating a budget, understanding credit scores, and planning for future financial goals. It's praised for its relatable tone and practical advice.

-

"The Simple Path to Wealth" by JL Collins

Overview: "The Simple Path to Wealth" by JL Collins provides a straightforward approach to wealth accumulation and financial independence. It's based on the author's popular blog series.

Key Takeaways: This book emphasizes the importance of saving, investing in low-cost index funds, and avoiding debt. It's renowned for its clear, concise advice and is particularly suitable for young adults looking to start their investment journey.

-

"A Teenager’s Guide to Investing in the Stock Market" by Jake Cousineau

Overview: Jake Cousineau's "A Teenager’s Guide to Investing in the Stock Market" introduces young adults to the world of stock market investing.

Key Takeaways: The book covers the basics of how the stock market works, how to start investing, and the importance of long-term investment strategies. It's a great primer for teenagers and young adults new to investing.

-

"I Will Teach You to Be Rich" by Ramit Sethi

Overview: In "I Will Teach You to Be Rich," Ramit Sethi offers a six-week program for financial fitness, covering a wide range of personal finance topics.

Key Takeaways: The book focuses on banking, saving, budgeting, and investing, all tailored for a modern audience. It's known for its actionable steps and no-nonsense approach to money management.

-

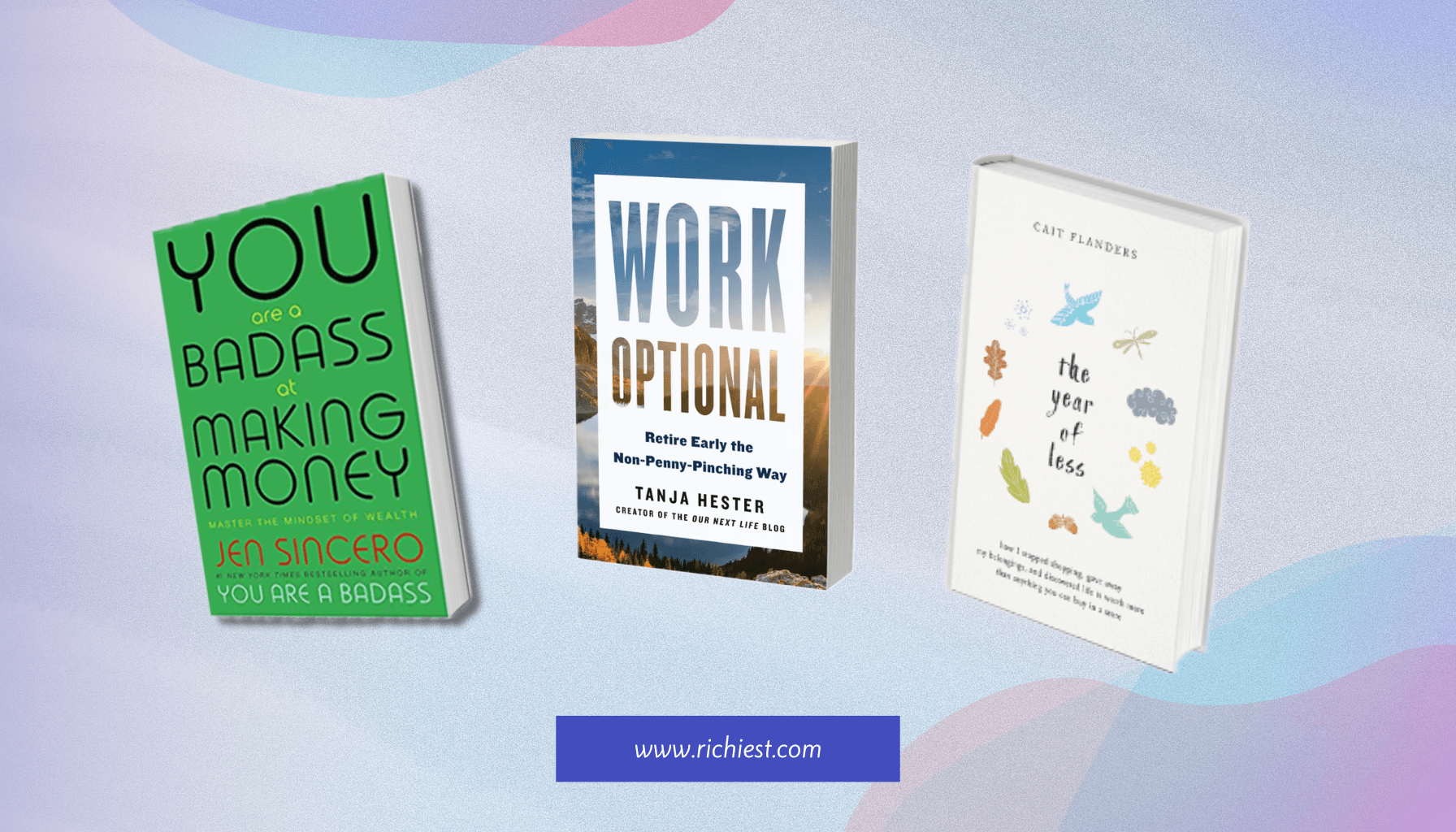

"You Are a Badass at Making Money" by Jen Sincero

Overview: "You Are a Badass at Making Money" by Jen Sincero combines personal anecdotes with practical advice, focusing on developing a mindset conducive to financial success.

Key Takeaways: This book is known for its motivational approach, encouraging readers to overcome financial insecurities and cultivate a mindset that attracts wealth. It's a blend of inspirational stories and actionable tips for improving one's financial situation.

-

"Work Optional: Retire Early the Non-Penny-Pinching Way" by Tanja Hester

Overview: In "Work Optional: Retire Early the Non-Penny-Pinching Way," Tanja Hester presents a guide to achieving financial independence and early retirement without living frugally.

Key Takeaways: The book offers strategies for saving aggressively, investing wisely, and making smart financial choices that enable early retirement. It's a comprehensive guide for those aspiring to retire early while enjoying a fulfilling lifestyle.

-

"The Year of Less" by Cait Flanders

Overview: "The Year of Less" by Cait Flanders is a memoir that documents the author's journey of decluttering her life, both physically and financially.

Key Takeaways: This book explores the relationship between consumerism and personal finance, offering insights into mindful spending, debt reduction, and the value of simplicity. It's a thought-provoking read for young adults looking to redefine their approach to money and possessions.

-

"Dear Debt" by Melanie Lockert

Overview: "Dear Debt" by Melanie Lockert is a personal journey through debt repayment. Lockert shares her experience of paying off $81,000 in student loan debt.

Key Takeaways: This book provides practical advice and emotional support for dealing with debt. It emphasizes the psychological aspects of debt and offers strategies for overcoming it, making it a relatable and motivational read for anyone struggling with similar financial burdens.

-

"168 Hours: You Have More Time Than You Think" by Laura Vanderkam

Overview: In "168 Hours: You Have More Time Than You Think," Laura Vanderkam explores the concept of time management and its impact on productivity and financial success.

Key Takeaways: The book offers insights into effectively managing your time to achieve your goals, including financial ones. It challenges readers to rethink their weekly schedules and priorities, providing a fresh perspective on balancing work, leisure, and personal finance.

-

"How to Win Friends and Influence People" by Dale Carnegie

Overview: Dale Carnegie's classic, "How to Win Friends and Influence People," although not a traditional finance book, offers invaluable lessons in interpersonal skills that can indirectly benefit financial and career success.

Key Takeaways: This book teaches timeless principles of effective communication, persuasion, and relationship building. These skills are crucial in various aspects of personal finance, from negotiating salaries to networking and building professional relationships that can lead to financial opportunities.

-

"Quit Like A Millionaire" by Kristy Shen and Bryce Leung

Overview: "Quit Like A Millionaire" by Kristy Shen and Bryce Leung is not just a guide about money; it's a personal story of how the authors went from living in poverty to retiring early and traveling the world.

Key Takeaways: This book offers unconventional wisdom on how to save money, invest wisely, and make life-changing decisions that lead to financial independence. It's an inspiring read for young adults aspiring to break free from traditional career paths and achieve financial freedom.

-

"Get Money" by Kristin Wong

Overview: In "Get Money," Kristin Wong combines personal anecdotes with actionable advice to make personal finance more approachable and fun.

Key Takeaways: The book covers a range of topics, including budgeting, investing, and negotiating. It's known for its engaging style and practical tips, making it a great read for young adults who want to learn about managing money without getting overwhelmed.

-

"Financial Freedom: A Proven Path to All the Money You Will Ever Need" by Grant Sabatier

Overview: "Financial Freedom" by Grant Sabatier is about transforming your relationship with money and achieving financial independence.

Key Takeaways: Sabatier shares his journey from being nearly broke to financially independent in five years. The book provides strategies for increasing income, saving more, and investing effectively. It's a motivational guide for young adults looking to fast-track their financial independence.

-

"Student Loan Solution" by David Carlson

Overview: "Student Loan Solution" by David Carlson is a comprehensive guide for managing and overcoming student loan debt.

Key Takeaways: The book offers practical advice on various repayment options, loan forgiveness programs, and strategies to pay off student loans faster. It's an essential resource for young adults grappling with student debt, providing clear steps to achieve financial freedom.

-

"The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

Overview: "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko offers a surprising look into the habits and lifestyles of America’s wealthy.

Key Takeaways: This book reveals that many millionaires live below their means and accumulate wealth through frugality and smart investing. It challenges young adults to rethink their perceptions of wealth and provides insights into building long-term financial security.

-

"Choose FI" by Chris Mamula, Brad Barrett, and Jonathan Mendonsa

Overview: "Choose FI" by Chris Mamula, Brad Barrett, and Jonathan Mendonsa is a guide to financial independence, drawing on the principles of the FIRE (Financial Independence, Retire Early) movement.

Key Takeaways: The book covers a range of topics from budgeting and saving to investing and tax optimization. It's a roadmap for young adults who aspire to achieve financial independence and live a life not dictated by financial constraints.

These books continue to provide young adults with diverse perspectives and practical advice on personal finance. From tackling student loans to understanding the principles of accumulating wealth, each book offers valuable insights for achieving financial stability and independence.

Conclusion

As we conclude our research on top finance and money books for young adults, it's clear that each title offers unique insights and valuable strategies for navigating the complex world of personal finance. From managing debt and understanding investing to achieving financial independence, these books provide a comprehensive toolkit for financial literacy.

Summarizing the Importance of These Books

- Building Financial Literacy: These books are crucial in helping young adults develop a solid foundation in financial knowledge, equipping them with the skills needed to make informed decisions.

- Diverse Strategies and Perspectives: The range of topics and approaches covered in these books ensures that readers can find guidance that resonates with their personal financial situations and goals.

- Empowerment Through Education: By demystifying financial concepts and offering practical advice, these books empower young adults to take control of their financial futures, fostering confidence and independence.

In summary, the importance of these books in guiding young adults towards financial literacy and independence cannot be overstated. They are more than just guides; they are resources that can shape financial attitudes and decision-making for a lifetime.